FALCON POWERS – Money is rushing into Chinese government bonds, sending their prices soaring and yields plunging to record lows as investors hunt for a safer alternative to the country’s ravaged real estate market and volatile stocks.

The yield on China’s onshore 10-year government bond, which is a benchmark for a wide range of interest rates, touched 2.18% Monday, the lowest since 2002 when records began. Yields on 20-year and 30-year bonds are also hovering around historic lows. Bond yields, or the returns offered to investors for holding them, fall as prices rise.

Lower borrowing costs should be welcome in an economy struggling to recover from a property crash, sluggish consumer spending and weak business confidence. But the sharp move in bonds is sparking talk of a bubble and triggering acute anxiety among China’s policymakers, who fear a crisis similar to the collapse of Silicon Valley Bank (SVB) last year.

The People’s Bank of China (PBOC) has issued over 10 separate warnings since April about the risk that a bond bubble could burst, destabilizing financial markets and derailing the Chinese economy’s uneven recovery. Now it’s doing something unprecedented —borrowing bonds to sell them to tamp down prices.

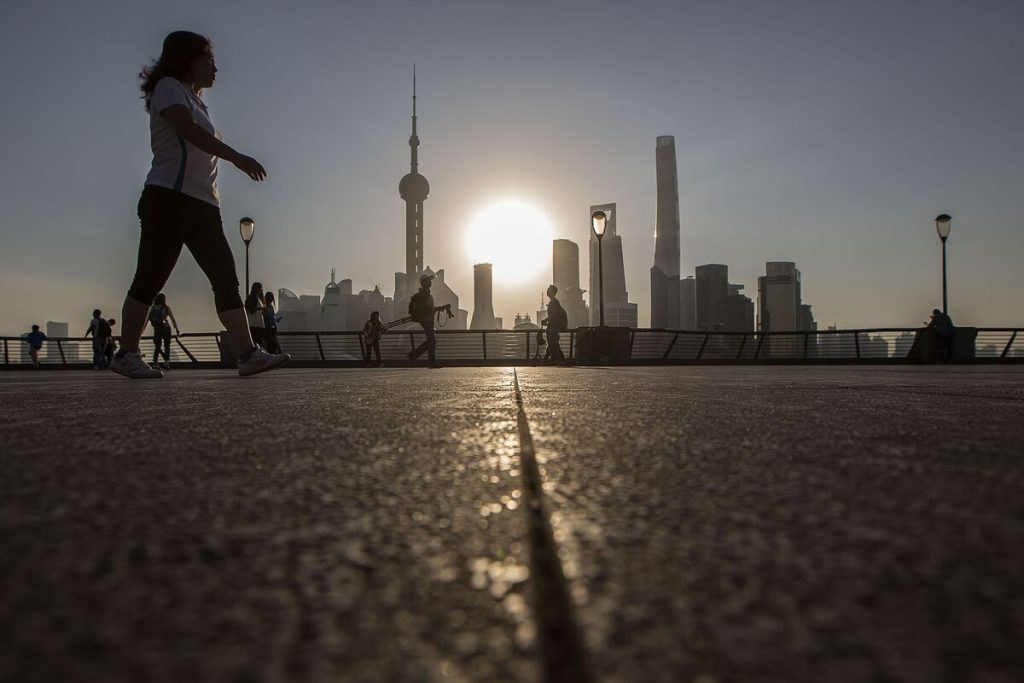

“SVB in the United States has taught us that the central bank needs to observe and evaluate the situation of the financial market from a macro-prudential perspective,” PBOC Governor Pan Gongsheng said at a financial forum in Shanghai late last month.

“At present, we must pay close attention to the maturity mismatch and interest rate risks associated with the large holdings of medium and long-term bonds by some non-bank entities,” the central bank governor added. Those entities include insurance companies, investment funds and other financial firms.

Lessons from the US

SVB was the biggest US bank failure since the global financial crisis. The roots of its demise lay in the fact that SVB had ploughed billions into US government bonds, an apparently safe bet that came unstuck when the Federal Reserve began hiking interest rates to tame inflation. Prices of the bonds SVB was holding fell, eroding its finances.

Policymakers in China fear the risk of a similar crisis in the world’s second largest economy if the bond frenzy goes unchecked. Prices of Chinese bonds have risen fast since early this year as investors pile into them because of the uncertain economic outlook. Businesses are also borrowing less, leaving banks with excess cash they have to park somewhere.

“Credit demand is weak due to the property woes. As a result, banks have to buy more bonds as money is trapped in the interbank market,” said Larry Hu, chief China economist for Macquarie Group.

A “deflationary outlook” for the economy has also taken hold among investors, prompting them to flock to long-term sovereign bonds, he added.

Similar to SVB, China’s financial institutions have invested a significant amount in long-term government bonds, which make them vulnerable to sudden interest rate changes.

Beijing is concerned that if the bond bubble pops, sending prices down and yields up, those lenders could suffer big losses.

“What worries policymakers is the interest rate risk, which will rise once the dominant narrative shifts from deflation to reflation,” Hu from Macquarie said.

In the first half of this year, net purchases of sovereign bonds by financial institutions, mostly by regional banks, were 1.55 trillion yuan ($210 billion), up 61% from the same period last year, according to an analysis of central bank data by Zheshang Securities, a state-controlled brokerage firm.

Official interest rates in China are low after cuts in recent years by the PBOC aimed at supporting the economy. Deflationary pressures have persisted — consumer prices rose less than expected in May and factory prices declined for the 20th month in a row.

But “once external demand slows, Beijing will have to step up stimulus to achieve its (economic) growth target,” Hu said.

If that happens, bond yields will rise as investors switch back into riskier stocks. Meanwhile, demand for credit should rise, banks will lend more and therefore reduce their holdings of government debt. This will cause the bond bull market to reverse, Hu said.

The country’s “4,000 or so small and medium-sized banks” will be particularly vulnerable to the interest rate risk, he added.